Hey there,

It looks like you have discovered Rembrandt’s Atelier.

Drawing lines for you directly from Obelix Capital HQ.

Here, you will learn what I think of FX markets combined with chart analysis and my thought process.

This will be very outlined as I love to talk in detail.

I sometimes go too far into detail, but it will be valuable.

A detailed approach is needed in FX.

Today’s post will be all about:

Why you should follow me on Substack and on Twitter

Why you should be

selling/buying GBP/JPY this weekUpcoming news events that will either ruin or support your GBP/JPY trade(s)

Why did I start a Substack?

After having read a few books and articles about growing a following by providing free value, I thought to myself; ‘‘Why not?’’

This means that I can share my daily, impulsive research here to myself.

If I can please you with it, that’s an extra bonus.

This Substack will basically be my daily journal, if you will.

Use it to your advantage and reach out to me on Twitter if you have any questions about my views and findings.

GBP/JPY: you are missing the point, because it is bearish but bullish at the same time!

I started today by looking at GBP/JPY.

Although, it’s not my main pair, but I looked at it today as I like GJ for its volatility.

It looks like it is in a major downtrend when looking at the daily timeframe:

From now on, I will use a different chart scheme as green and red are impacting your trading psychologically.

It also took out some highs lately to grab some buy side liquidity to accumulate enough sell orders for further downside. The market has seen some distribution already, yet the market is still in manipulation phase.

If I were you, I would draw some premium area’s to buy into.

It would look like this for me, taking the H1 timeframe with 2 possible buy setups for the near term:

Scenario 1 with a RR of 1:5

Scenario 2 also with a RR of 1:5

This scenario is more interesting, as there is more upside potential in this. Price needs to first breach the short term lows and makes a run for liquidity in my green box, where we will be looking to buy. All this extra liquidity should provide further downside.

Why these areas I hear you ask?

At 164 flat, the market has a double top formation.

This means that a lot of buy stops will be residing there.

Guess where the market is headed?

Exactly. There and possibly higher.

Higher where?

Into our final profit target outlined in red with the first white magnet.

There, the market will enter an area considered as a market premium

This means that the market is at expensive prices and as we are in a major downtrend, as outlined above, it means that the market is highly likely to reverse there.

A full in-depth sell scenario will follow as this post will be too long.

Upcoming news events that will either ruin or support your GBP/JPY trade(s)

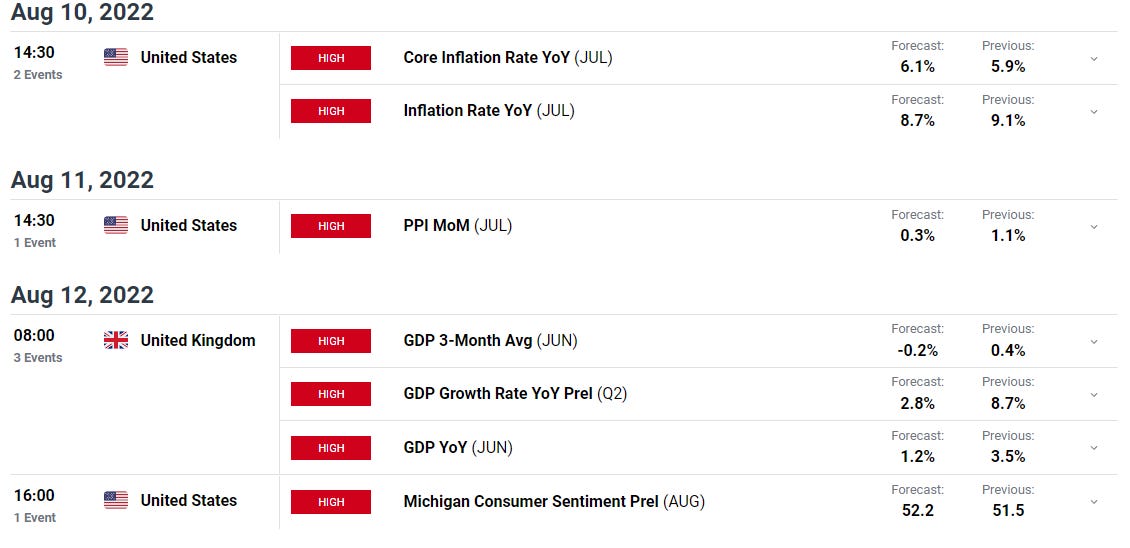

Screenshot taken from dailyfx.com/economic-calendar

If I were you, look out for the USD numbers as this will further fuel risk on/off sentiment this week.

Inflation is soaring right now and that is obviously something negative for the economy.

Although good for its native currency, it is seen as bad for the economy and therefore markets will trade with a risk off sentiment, causing safe haven assets to appreciate (such as JPY and Gold).

To put this into practice for you, higher than forecasted US inflation numbers will fuel a risk off sentiment and cause the safe haven assets to appreciate in price.

This affects our trading and practically this would mean that JPY will strengthen if inflation will be higher than expected; therefore you should NOT trade GBP/JPY in this case.

When US inflation is below expectations, this would make a softer JPY resulting in a higher GBP/JPY. Only in this case would I be looking to trade this pair this week.

Sterling is also having heavy news combined with consumer sentiment, although I do not trade friday’s and recommend you to do the same.

With that said…

Thank you for reading my first Substack post!

Let me know if you enjoyed it and have any questions whatsoever! :)

So long,

Rembrandt

PS. I am available all day to answer all your FX questions on Twitter. Obelix Capital got you sorted in every way you possibly can imagine. Go ahead and check this out now. Or if you want to see how credible I am, click here and you will discover how I predicted a 1:6 Risk to Reward move on Bitcoin lately. Or a quick scalp on ETH/BTC if you will.

PPS. make the world a better place and share this article around. It would make my day and it will keep me doing these extensive tactical plans. How wonderful.